How to figure customer acquisition cost (CAC)

Customer acquisition cost is a metric that every business, especially those in the sales and marketing domain, needs to understand and evaluate. It refers to the amount of money spent on acquiring new customers, and it plays a critical role in determining the profitability of a business's acquisition efforts.

In this blog, we dive deep into the world of what customer acquisition means, exploring its significance, calculation methods, and strategies to improve it. By the end, you will have a clear understanding of CAC and how to effectively manage it for long-term business success.

Understanding Customer Acquisition Cost (CAC)

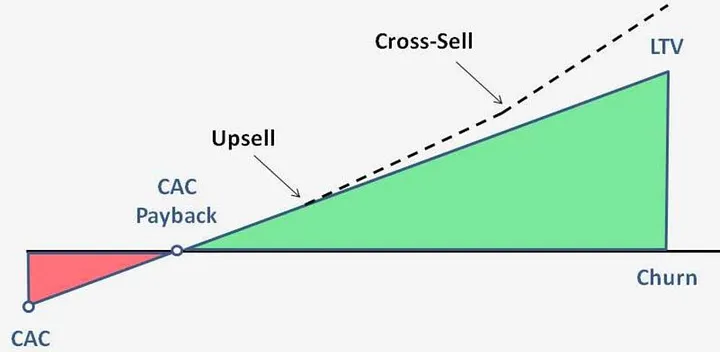

Customer Acquisition Cost is a critical metric for businesses to comprehend. It helps determine the cost of acquiring new customers and can be calculated using a specific formula. Understanding CAC ratio and its significance to a business's profitability is paramount. CAC holds immense importance, particularly for SaaS companies, as it measures the payback period and influences the long-term revenue potential. Evaluating CAC on a monthly basis against the customer's lifetime value provides the best rule of thumb for efficient cost management.

What constitutes CAC?

It encompasses the expenses related to sales and marketing efforts, such as advertising, salaries, and overhead costs. It includes the money spent on lead generation through various marketing channels. Understanding CAC involves analyzing the total expenses incurred to acquire paying customers.

Importance of CAC to a business

Efficiency in customer acquisition strategies is crucial for any business, and understanding the importance of Customer Acquisition Cost is the key to achieving this. CAC directly measures the effectiveness of marketing campaigns and impacts the profitability of acquisition teams in the long run. Moreover, knowing the CAC helps in optimizing marketing expenses and assists in determining the lifetime value of customers. By focusing on CAC, businesses can make confident, innovative decisions to enhance their customer acquisition strategies and drive long-term success.

How to figure Customer Acquisition Cost

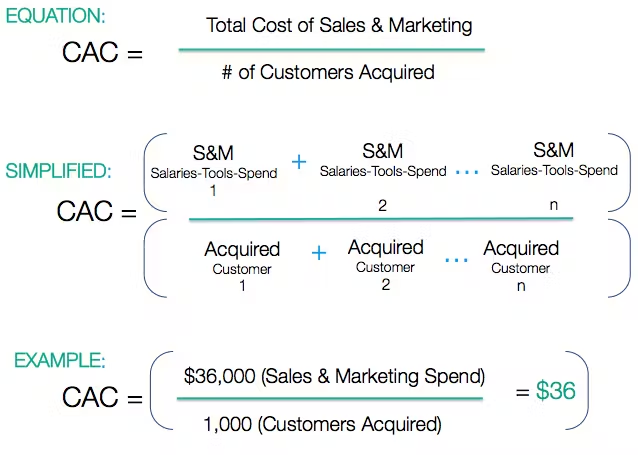

To calculate Customer Acquisition Cost, consider the standard formula, including sales and marketing expenses. Factor in the role of new customers acquired in the specific period to evaluate CAC ratio and determine the cost of acquisition. SaaS businesses often use the best rule of thumb to calculate CAC on a monthly basis. Additionally, they analyze the payback period and LTV ratio to make confident, innovative decisions for optimizing CAC. This approach ensures long-term profitability and aligns strategies with customers' buying preferences.

Source: Watcher Joaquim @Medium

Standard formula for CAC calculation

Estimating the profitability of acquisition strategies involves dividing the total acquisition cost by the number of new customers acquired within a specific period. This aids in evaluating customer acquisition expenses and ascertaining the profitability of marketing efforts. The CAC metric is a crucial factor in determining how much revenue can be generated in the long term and represents the best rule of thumb for SaaS businesses. Additionally, it helps in understanding the payback period and optimizing the cost of acquisition for SaaS companies.

Inclusion of sales and marketing expenses

Analyzing the cost of sales and marketing efforts is crucial in how to figure customer acquisition cost. Sales team costs are included to determine the total expenses incurred in customer acquisition. The CAC metric also encompasses marketing expenses, contributing to the overall cost of customer acquisition. Understanding these expenses is essential for SaaS businesses to evaluate their CAC ratio and optimize profitability. Considering sales and marketing costs on a monthly basis provides insight into the long-term impact on the company's gross margin and LTV ratio, aligning with the best rule of thumb for CAC evaluation.

Role of new customers acquired

The acquisition of new customers is a crucial factor in determining the overall CAC and assessing the profitability of marketing strategies. Calculating CAC involves analyzing the expenses incurred in acquiring new customers, while understanding their role is pivotal in this calculation. The number of new customers acquired directly impacts the CAC ratio and assesses the cost of acquiring customers over a specific period. This analysis is essential for SaaS businesses and companies to determine the effectiveness of their customer acquisition strategies.

Source: Paddle

Different Methods to Calculate CAC

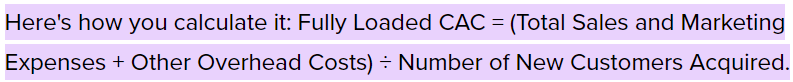

Now let's explore different methods to calculate CAC, each serving a specific purpose in evaluating profitability. Understanding these methods is essential for optimizing marketing strategies and making informed decisions.

The fully loaded CAC formula

How to figure customer acquisition cost using the fully loaded formula provides a holistic view of acquisition cost, encompassing all sales and marketing expenses. This comprehensive approach is crucial for thorough cost analysis and aids in gauging marketing strategy profitability. Understanding the fully loaded CAC formula allows businesses to assess the lifetime value of customers, providing valuable insights for long-term growth and sustainability. By utilizing the fully loaded formula, businesses can gain a deeper understanding of their customer acquisition costs and make informed decisions to optimize their marketing strategies.

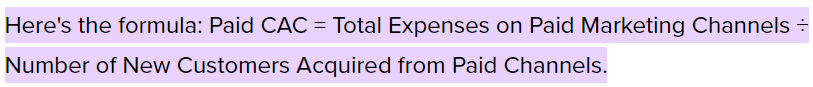

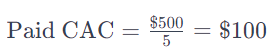

The paid CAC formula

Venturing deeper into the realm of Customer Acquisition Cost (CAC), let's now turn our attention to paid acquisition channels, where the 'Paid CAC' metric takes center stage.

Definition: Paid CAC reveals the cost incurred on paid marketing channels to acquire a new customer. These channels could include platforms like Google Ads, Facebook ads, or any other paid advertising avenues.

Example: Imagine you spent $500 on paid ads and, as a result, acquired 5 new customers. Applying the Paid CAC formula, you would calculate it as follows:

Utility:

- Cost-Effectiveness Evaluation: Gauge the efficiency of your paid marketing strategies by analyzing the Paid CAC.

- Comparison Tool: Compare performance across different channels to identify the most effective ones.

- Strategic Optimization: Armed with Paid CAC insights, adjust your marketing strategies and optimize spending for better results.

In essence, Paid CAC is your compass for maximizing return on investment. By leveraging this metric, businesses can make informed decisions, ensuring that every dollar spent on paid advertising contributes to the overall success of their customer acquisition endeavors.

Evaluating Profitability using CAC

Evaluating business profitability using the CAC ratio is crucial for long-term success. The LTV/CAC ratio offers insights into the long-term value of customers acquired in a specific period and their associated acquisition costs. SaaS businesses often track this metric to ensure they are making enough revenue from customers over a specific period, aligning with the best rule of thumb for CAC payback period. By understanding the impact of CAC on gross margin and total sales, businesses can make innovative decisions to optimize CAC and maximize profitability.

Introduction to LTV/CAC ratio

Assessing the relationship between customer lifetime value (LTV) and cost of acquisition is crucial for a business's long-term success. Analyzing the long-term profitability of acquisition strategies involves evaluating the potential LTV of customers and comparing it against the acquisition cost. This assessment allows businesses to measure the profitability of their acquisition channels and optimize their strategies for sustainable growth. Understanding this relationship is a best rule of thumb for SaaS companies aiming to improve their CAC ratio and long-term revenue on a monthly basis.

Significance of LTV/CAC ratio in business profitability

Assessing the customer’s lifetime value ratio is crucial for business growth, determining the profitability of acquisition methods, and evaluating the long-term effectiveness of the acquisition strategy. It allows businesses to analyze the effectiveness of marketing channels and enhance acquisition strategies based on lifetime value. This approach ensures a focus on the long term and the overall impact on the business's profitability, making it a best rule of thumb for SaaS companies and businesses looking to optimize their CAC ratio for sustainable growth and profitability.

Source: Eleken

Strategies to Improve CAC

Understanding how to improve this cost is crucial for a SaaS business' profitability. To enhance CAC, focus on knowing your target audience, optimizing website conversions, utilizing organic channels, and increasing customer value. By aligning strategies with customers' buying preferences, you can effectively lower CAC. Additionally, leveraging marketing automation can significantly reduce CAC, leading to higher profitability and growth for the business. Emphasizing these strategies and aligning them with the specific needs of the target audience can greatly impact CAC positively.

Knowing your target audience

Understanding your target audience is crucial for any business. Identifying the specific demographics, preferences, and behaviors of your potential customers can help you tailor your marketing strategies effectively. Analyzing the number of customers within each segment and understanding their needs will enable you to create targeted content that resonates with them. By doing so, you can increase your CAC ratio and LTV ratio, which are vital metrics for the profitability of a SaaS business. Additionally, focusing on organic channels and optimizing content marketing based on your audience's preferences can significantly impact your CAC and overall revenue.

Optimizing website conversions

Optimizing website conversions is crucial for boosting the number of customers and improving the CAC ratio. By focusing on content marketing, SaaS businesses can attract more visitors to their websites and increase monthly recurring revenue. Optimizing for specific periods, such as peak sales seasons, can also lead to much revenue. Implementing the best rule of thumb strategies for CAC optimization, like understanding the payback period and customer lifetime value ratio, can significantly impact a company’s gross margin and long-term profitability.

For SaaS companies, a healthy LTV to CAC ratio is often considered to be around 3:1. This means that for every dollar spent on customer acquisition, the company expects to generate three dollars in lifetime value from that customer.

Focusing on organic channels

When aiming to enhance customer acquisition cost without direct spend, organic channels are a go-to choice. Leveraging content marketing and optimizing for Google search delivers quality leads with high LTV ratio. SaaS companies often benefit from an increased number of customers via organic channels, leading to higher monthly recurring revenue and improved CAC ratio. By aligning content with customer preferences and strategically employing SEO, businesses can consistently attract new customers at minimal cost of acquisition, ensuring long-term profitability.

Increasing customer value

By maximizing customer value, businesses can boost their revenue and establish long-term relationships. One approach is to focus on increasing the number of customers' purchases and their average spend. Moreover, a good rule of thumb is to enhance LTV/CAC ratio by providing valuable content marketing and personalized experiences. This proactive strategy ensures sustained growth and maximizes the gross margin, ultimately leading to a substantial increase in total sales.

Role of Marketing Automation in improving CAC

Marketing automation enhances CAC efficiency by automating tasks, nurturing leads, and analyzing customer behavior. It streamlines acquisition, reducing costs. Automated workflows help manage leads, personalize communication, improving conversion rates and revenue. Incorporating marketing automation tools in the customer acquisition strategy is a crucial step for SaaS companies to maximize their CAC ratio and long-term profitability.

Understanding marketing automation

Marketing automation is a transformative strategy that uses automated tools to optimize customer experiences, expand the customer base, and enhance operational efficiency. It involves intelligently deploying automated processes for streamlined marketing, ensuring dynamic and targeted engagement with the audience, ultimately driving sustained success in a competitive landscape.

How marketing automation can reduce CAC

By leveraging marketing automation, businesses can significantly decrease customer acquisition costs, enhance customer lifetime value, and boost the profitability of their acquisition teams. This technology effectively reduces marketing expenses while also increasing the number of new customers. By streamlining and automating marketing processes, businesses can optimize their strategies and allocate resources more efficiently, ultimately resulting in a reduction in CAC. Embracing marketing automation is an innovative approach that holds the potential to revolutionize the way businesses acquire and retain customers, making it a crucial element in today's competitive landscape.

How does alignment of strategy with customers' buying preferences affect CAC?

Aligning your strategy with customers' buying preferences has a significant impact on your Customer Acquisition Cost. It lowers it by attracting more customers, increasing their lifetime value, and improving the profitability of your acquisition teams. Additionally, strategy alignment reduces marketing expenses, resulting in a more cost-effective customer acquisition process.

Conclusion

In conclusion, how to figure Customer Acquisition Cost is crucial for any business to evaluate its marketing efforts and measure profitability. By knowing the cost associated with acquiring new customers, businesses can make informed decisions about their marketing strategies and allocate resources effectively. The standard formula for calculating CAC is a useful starting point, but it's important to consider additional expenses and the role of new customers in the calculation. Evaluating profitability using the LTV/CAC ratio provides valuable insights into the return on investment. To improve CAC, businesses should focus on knowing their target audience, optimizing website conversions, leveraging organic channels, and increasing customer value. Additionally, marketing automation can play a significant role in reducing CAC by streamlining processes and improving efficiency. By understanding the factors influencing CAC and aligning strategies with customers' buying preferences, businesses can optimize their CAC and drive growth in a cost-effective manner.

Looking for more efficient customer acquisition tactics?

Advanced Tactics

Data-Driven Insights

Automated Marketing Plans

Copyright © 2025 AskCory. All rights reserved.

Built by Build Up Labs, from sunny Lisbon to the world :)